carbon tax benefits and disadvantages

Value Added Tax VAT- Meaning Advantages and Disadvantages. It puts the responsibility of the social cost of carbon pollution onto the.

Factbox Carbon Offset Credits And Their Pros And Cons Reuters

Lower potential quality of products especially smaller.

. Carbon tax vs carbon trading two sides of the same coin. For example 16 is 6 higher than the recent auction value of Californias cap-and-trade allowances for 2015 but about 13. List of Advantages of Carbon Tax 1.

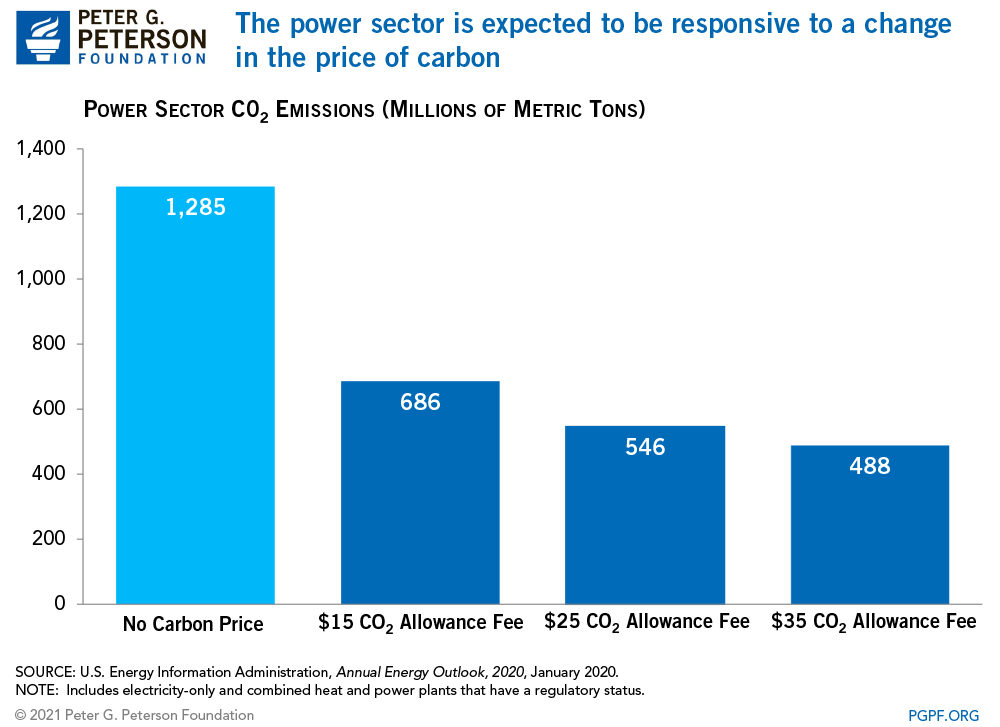

It is easier and quicker for governments to implement. High prices for carbon-emitting goods reduce demand for them. Many types of businesses can benefit from switching to green production.

It encourages people to find alternative resources. A carbon tax reflecting the social cost of carbon is viewed as an essential policy tool to limit carbon emissions. The carbon tax is the most equitable method for carbon use to pay for its pollution.

A carbon tax also has one key advantage. Advantages of the Carbon Tax. Higher potential quality of bike frame and other large objectscomponents.

Although it may be tough at first some companies choose to take on this huge role of applying greener. Carbon offsetting has benefits at both ends of the process. The system needs to be employed by law similar to other sin taxes on alcohol.

It can rely on existing administrative structures for taxing. With the carbon tax causing increases in business overheads companies will be prompted to find more. A carbon tax can be very simple.

Federal carbon tax and 16 also falls within their range. Pressure for a faster energy. It helps environmental projects that cant secure funding on their own and it gives businesses.

Carbon capture and storage is one of the most efficient methods of extracting carbon emissions permanently from the environment. Value-Added Tax VAT is a type of indirect tax that is levied on goods and services and the payment is. The Pros of Carbon Offsetting.

In simple terms a carbon tax imposes a price on the carbon emitted by countries and corporations. The numerous advantages of CCS. In pursuit of reducing greenhouse gas emissions various countries have adopted the.

Higher incentive for people to avoid the use of fossil fuels. Companies have an incentive to go green as well.

27 Main Pros Cons Of Carbon Taxes E C

27 Main Pros Cons Of Carbon Taxes E C

/cdn.vox-cdn.com/uploads/chorus_asset/file/11712725/shutterstock_586114652.jpg)

Carbon Tax Debate The Top 5 Things Everyone Needs To Know Vox

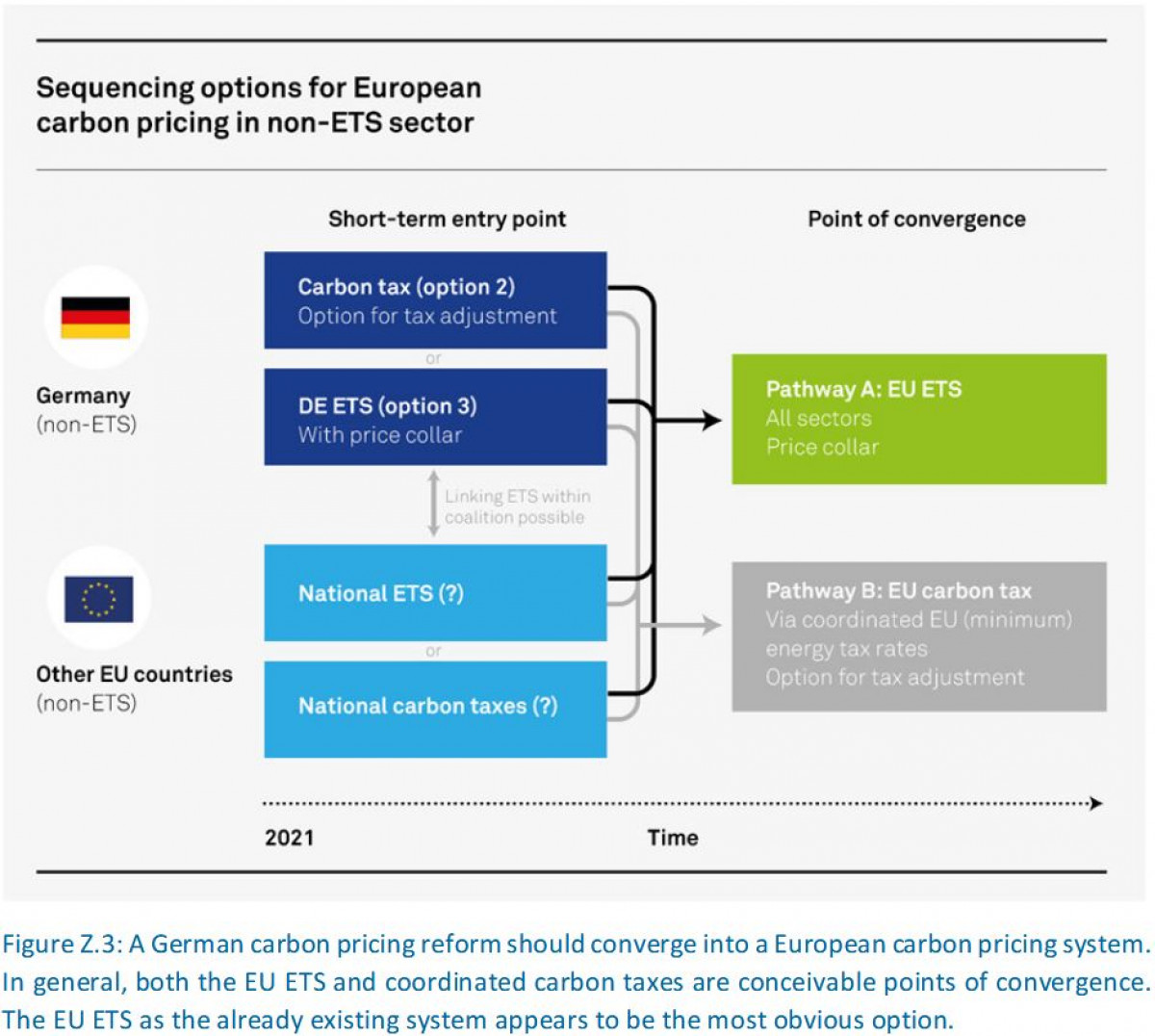

Putting A Price On Emissions What Are The Prospects For Carbon Pricing In Germany Clean Energy Wire

What Is A Carbon Tax How Would It Affect The Economy

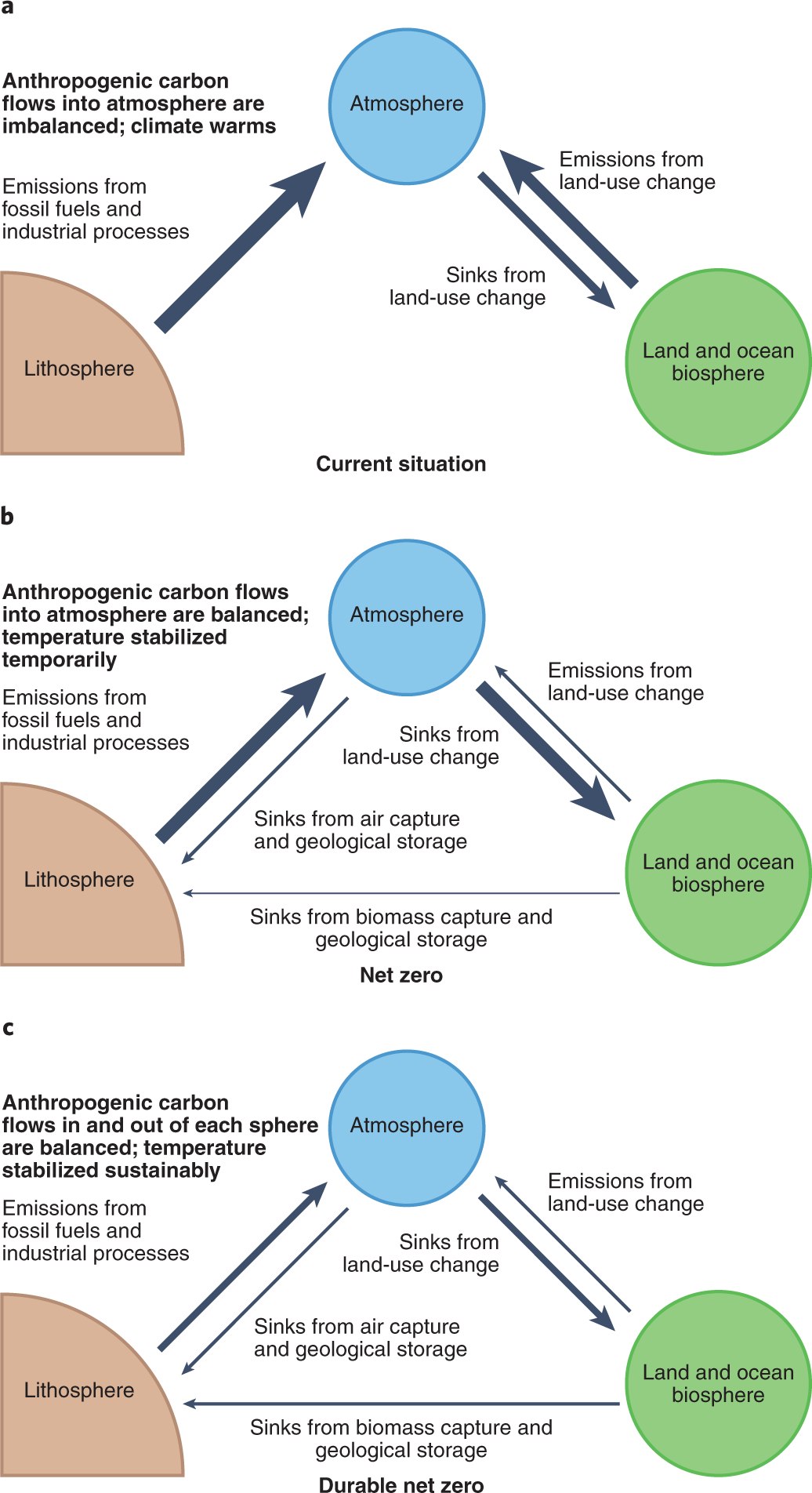

The Role Of Carbon Capture And Utilization Carbon Capture And Storage And Biomass To Enable A Net Zero Co2 Emissions Chemical Industry Industrial Engineering Chemistry Research

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

Carbon Tax Pros And Cons Economics Help

27 Main Pros Cons Of Carbon Taxes E C

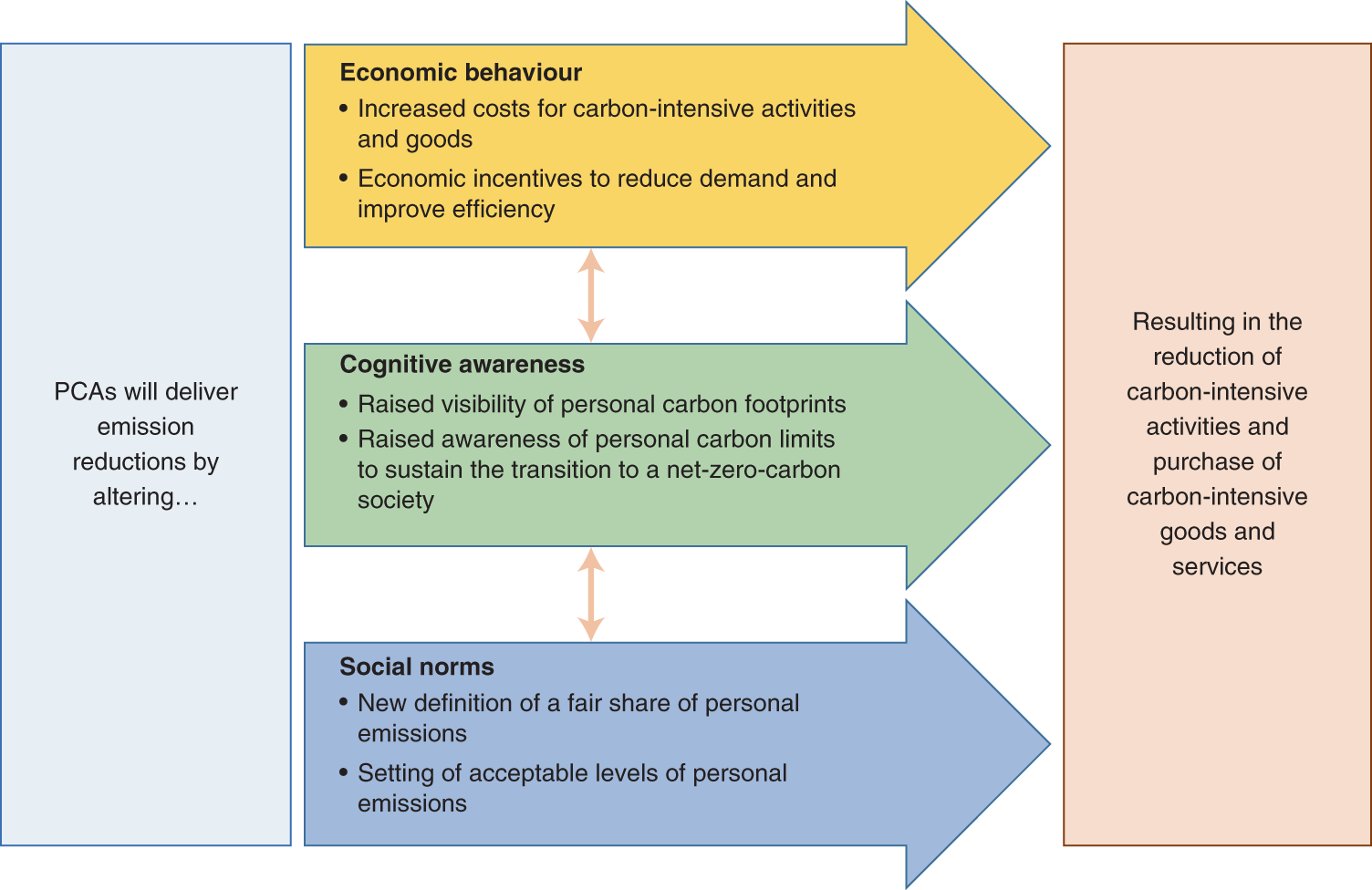

Personal Carbon Allowances Revisited Nature Sustainability

Could Revenue Recycling Make Effective Carbon Taxation Politically Feasible Science Advances

Australian Carbon Tax Guide With Pros And Cons Green Eatz

Synoptic Revision Micro Macro Effects Of A Carbon Tax Youtube

8 Pros And Cons Of Carbon Tax Brandongaille Com

Carbon Tax Pros And Cons Economics Help

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

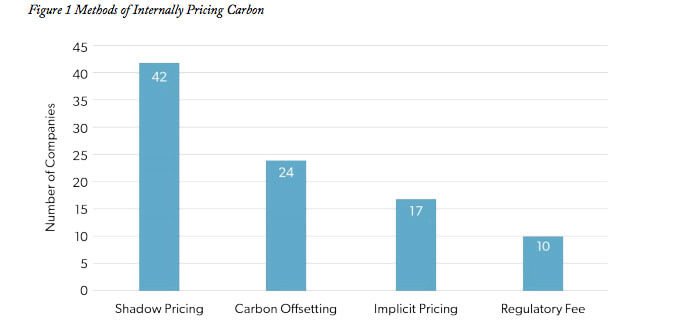

Carbon Pricing In The Private Sector The Cgo

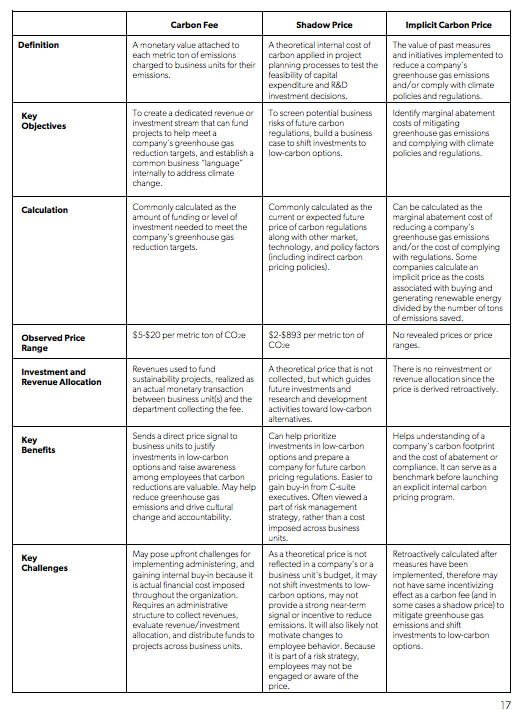

The Meaning Of Net Zero And How To Get It Right Nature Climate Change